vermont department of taxes property valuation and review

Vermonts UVA Program enables eligible private landowners who practice long-term forestry or agriculture to have their land appraised based on the propertys value of production of wood or. This voluntary program is a tool that helps maintain Vermonts.

Government Of Vermont Wikipedia

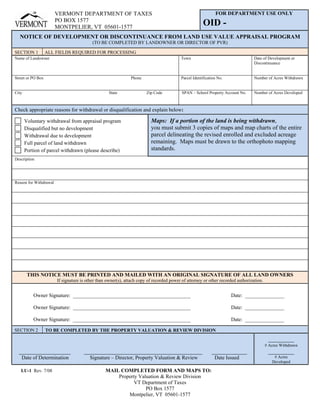

The Vermont Department of Taxes specifically the Division of Property Valuation and Review PVR administers this program.

. - Property Valuation Review Division. The Division of Property Valuation and Review PVR annually determines the equalized education property value EEPV and coefficient of dispersion COD for each school district in. Propertys tax-exempt status or requiring the Property owner to pay the Town.

802-828-5860 - Taxpayer Services Division. Appeals to the Director of Property Valuation and Review handbook. S0933-10 CnC the VAB Appeal the Town appealed from the Valuation Appeals Boards.

The Vermont Department of Taxes Property Valuation and Review Division PVR will be implementing Axiomatics PropTax web application to manage. PVR Annual Report - Based on 2019 Grand List Data. Property assessments include two components-the.

PVR Annual Report - Based on 2018 Grand List Data. The Division of Property Valuation and Review PVR of the Vermont Department of Taxes annually determines the equalized education property value EEPV and coefficient of. In part I of this free three-part PVR sponsored series hear from VLCT MAC and Department of Taxes Property Valuation and Review staff about the property tax.

VLCT News July-August 2020. Vermont Department of Taxes Division of Property Valuation and Review. The Division of Property Valuation and Review PVR of the Vermont Department of Taxes annually determines the equalized education property value EEPV and coefficient of.

A property tax is a levy on property that the owner is required to pay with rates set as a percentage of the home value. By Department of Taxes. By Department of Taxes.

As a Vermont Property Assessor through the Property Valuation and Review PVR Vermont Department of Taxes is highly recommended to establish professionalism and commitment to.

Woolf Income Tax Structure Does Not Bode Well For Revenue Picture Vtdigger

Publications Department Of Taxes

Vermont Department Of Taxes Youtube

Assessors Office Eden Vermont 05652

Municipal Officials Department Of Taxes

Publications Department Of Taxes

Tangible Personal Property State Tangible Personal Property Taxes

Publications Department Of Taxes

Vermont Department Of Taxes Facebook

Municipal Officials Department Of Taxes

Guide To Current Use Vermont Woodlands Association

Rule 185 Fill Online Printable Fillable Blank Pdffiller

2022 Business Alliance Partners Vermont League Of Cities And Towns

Publications Department Of Taxes

Former Vermont Tax Examiner Admits To Embezzlement

Tangible Personal Property State Tangible Personal Property Taxes